You’ve finally decided that you’re going to outsource some or all of your payroll woes! But when you sit down to research the market and find potential vendors, you’re overwhelmed by a never-ending list of payroll service providers — each claiming to be the best.

When considering payroll options, it’s important to choose a reputable company. Ultimately, it’s your business that’s responsible for paying your employees and your taxes on time — not the payroll service provider.

There’s a lot at stake here. You should do your homework to ensure the payroll company you pick is compliant with regulatory standards, offers what you need, and is reliable.

1. Shortlist Your Options Based on First Impressions

The payroll industry is huge, with thousands of service providers that collectively generate around $22 billion in revenue. Selecting a company that’s the perfect fit from all the available payroll options is tough. The best way to start is to select a handful of companies based on reputation and customer reviews.

Ask other business owners or payroll professionals who they recommend and why. Hearing directly from a company’s customers is a great way to get a first impression and evaluate its processes.

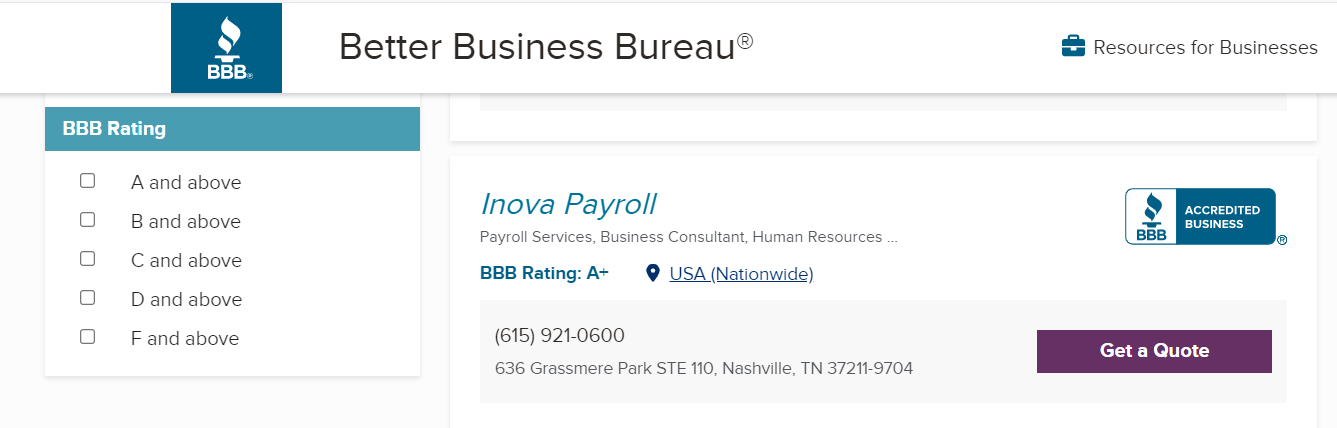

You can also look up reviews of companies with the Better Business Bureau by searching for “payroll service” or the name of a specific company. The BBB will provide a grade and information such as how long the company has been in business, contact information, and consumer reviews.

Inova Payroll has an A+ rating on BBB due to our impeccable track record and customer support

Inova Payroll has an A+ rating on BBB due to our impeccable track record and customer support

Additionally, software review sites like G2.com and industry directories like the SHRM Vendor Directory are helpful in gaining the perspective of the company’s customers. You’ll also find reviews on Google and Facebook that are helpful.

Finally, make a list of the options you’ve shortlisted based on the opinions of your peers and the customer reviews of the payroll companies.

2. Consider the Requirements of Your Business

The next step is to further narrow down your options by asking yourself what you need. A small business might only need a cloud-based payroll system. On the other hand, a larger company may need a full-service payroll provider, like a human capital management (HCM) solution. For perspective, here’s what a modern company should offer:

- Payroll Software: Automatically processes payroll and manages related documents like tax forms. This can either be cloud-based or on premises.

- Integrations: Seamlessly connects with other systems, such as a time tracking tool, accounting software, people analytics platform, or human resource information system (HRIS).

- Deductions: Deducts garnishments such as child support payments and withholds taxes as well as contributions to employee benefits programs such as retirement plans and health insurance.

- Payment Options: Makes payments through paychecks, direct deposits, paycards, or early wage access (advance).

- Tax Payments and Filing: Pays federal, state, and local payroll taxes and files quarterly reports to the appropriate entities on your behalf.

- New Hire Reporting: Reports new employees to the government with your company and adds them to your payroll.

Other potential offerings include a user-friendly mobile app, employee self-service, multi-year payroll history tracking, and uninterrupted customer support. Make a list of your priorities, and see which of your shortlisted options meet your payroll needs.

3. Ask the Right Questions

Managing payroll is a huge responsibility. Entrusting this responsibility to an outside company warrants asking additional questions about security and quality of services to ensure you find a nice fit.

Before anything else, ensure that the companies you shortlist have the proper payroll security measures and protocols in place. Remember that, as an employer, you’re the custodian of your employee data, which includes personal information required to run payroll. Your company will be held accountable if that data is breached, even if you outsource payroll processing. Examples of measures include firewalls, encrypted data, and secure data storage with redundancy.

More importantly, the payroll company employees should have received ample training on data security. Plus, the payroll company should have a solid policy or even insurance for data breaches. All of this information may be difficult to find online, so you’re better off speaking to the reps to get this information.

In addition to security, here are a few more questions you should ask potential payroll service providers before making the final decision:

- What services do you offer, and what certifications do staff members hold? The company should ideally have a CPA on staff. Other professional certifications held by payroll specialists (like the Society of Human Resource Management or the American Payroll Association) are a good sign of a quality organization.

- How often are internal controls audited, and do you provide the results to customers? Payroll companies should perform audits at least annually, and they should provide a copy of their report to customers if requested.

- Is the company bonded and insured? Find out how much the company is insured for and request a certificate of insurance.

- How do you remain up-to-date with regulatory requirements? A considerable number of federal, state, and local tax regulations affect your payroll processing. It’s important to find a company that has an airtight process for staying up to date on all of the changes from different jurisdictions.

It’s also a good idea to request a copy of the company’s service-level agreement, which should include information on things like the level of support provided and call-back times. Additionally, make sure the agreement you will sign with the company includes their data security and privacy standards. Read all documents thoroughly and, if possible, get them reviewed by your general counsel before signing.

4. Protect Your Company Against Payroll Penalties

While your payroll company can take on many payroll tasks, your company is still responsible for making correct, timely employment tax payments. Reputable payroll companies would pay penalties if it was their mistake. Be sure to ask before signing the agreement. Even with a reputable vendor, you should take precautions to protect your company.

- Enroll in the Electronic Federal Tax Payment System. Your payroll service can do this for you, and make sure you receive an EFTPS PIN so you have access to the account.

- Ensure tax notices are sent to you and not the payroll provider.

- If you receive a notice from the IRS about a problem with your payroll taxes, contact your payroll service provider as soon as possible. Mistakes happen, and a good payroll provider will handle the notice and keep you up-to-date on the progress to resolution.

- Have the company pay for any mistakes, especially if they back up their payroll tax filing with the promise to compensate for errors, including IRS penalties.

- If you think your payroll service is engaging in fraudulent activity, contact the IRS and file a complaint using IRS Form 14157 Complaint: Tax Return Preparer.

Choosing the Right Payroll Partner is Good for Your Bottom Line

As with any vendor selection process, it’s important to complete proper research and ask the right questions when considering payroll service providers. Because of the regulations covering employers and payroll taxes, you want to be sure you are making a good choice.

Understand exactly what you’re paying for. Review all related service agreements, and hold the provider to them. Know your options if problems arise. The good news is that following these steps will likely save your company time and money and give your team more flexibility to work on other important tasks.

If you’re about to begin your search for a payroll provider, give Inova Payroll a shot. Get in touch with us and find out if we’d make a good fit!